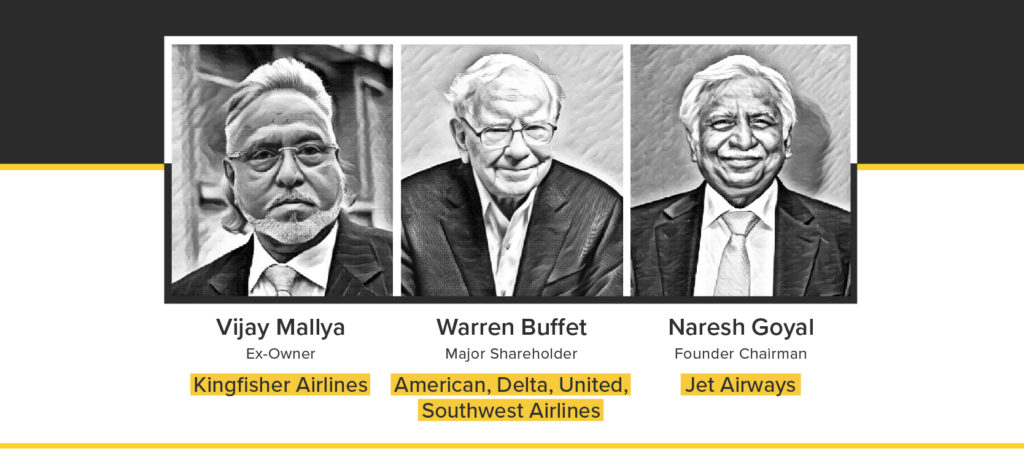

For billionaires around the world, buying a jet seems to be an unsaid rite of passage. Even the most seemingly frugal of them all – Warren Buffett – had famously fallen prey to the charms of the airborne chariot (before selling it in a spectacular hurry).

Despite this, every once in a while, a billionaire goes the whole nine yards to take the reins of a fledgling/ailing aviation business.

The latest name in this narrative is ace investor-turned-promoter Rakesh Jhunjhunwala and his anticipated upstart, Akasa Air, which is expected to grace the skies in June 2022 [Update: Now August 2022]. But given the widespread turmoil in the industry since the pandemic, all fanfare must be taken with a pinch of salt.

After all, the last time a billionaire bought an airline in India, he was still called the ‘King of Good Times.’

Flight of the bull

Hailed as the ‘Big Bull’ of the Indian stock market, Rakesh Jhunjhunwalla and his homegrown investment company ‘RARE Enterprises’ have been astute stock-pickers for over 3 decades. He has made over 10,000% from his stake in Titan (including dividend and share splits), and multifold profit through investments in Sesa Goa and Lupin – enough to convince anyone about his mettle in the realm of investing. When it comes to the aviation industry, he has made a tidy sum off his investments in both SpiceJet and Indigo, the latter being purchased at IPO less than a decade ago.

However, identifying the potential of growth is an entirely different ballgame from actively promoting a company and running operations for an airline. This especially holds true in a year where the industry has bled billions just to stay afloat (or in this case, airborne).

To make matters far more difficult, the Tata Group bought back Air India in late 2021, and the Tata trifecta (Vistara, Air Asia India and Air India) aims to capture all segments of air travellers, from the discerning to the more budget-conscious. What’s even more crucial is that with the buyout, the group has secured key planes and preferred slots at airports both in India and abroad. Not to mention, Indigo continues to command a formidable 60% of the Indian market making a price war in the sector inevitable in the years to come.

So what will it take for Akasa Air to win the skies? What does a win even look like? Let’s take a look at both sides of the coin.

Tailwinds

Akasa Air plans to mark its debut as a low-cost carrier with a fleet of 18 planes. What this means is that Akasa Air will offer attractive (i.e. cheapest) base fares to travellers while all additional services such as F&B services, preferred seating and extra baggage charged additionally.

If Akasa invests in the right planes, which in this case happens to be the thin-bodied Boeing 737 Max, it can minimize the cost per seat on the aircraft and improve margins through the add-ons.

Start small, stay humble

A good strategy would be to compete against homegrown players in regional markets and less popular routes – where they face little to no competition.

In the west, low-cost carriers dominate less popular routes or secondary airports in key destinations, helping them reduce costs and stay competitive. Since that model is yet to take form in India, Akasa could benefit from cutting its teeth by taking on local players first.

Take the example of Star Air – the aviation arm of the Sanjay Ghodawat Group, that connects 14 cities in the country and commands a meagre 0.2% of the total market share. However, due to its low base effect, the airline charted an impressive recovery, growing 50% YOY in 2021 as compared to its pre-pandemic figures.

By focussing on destinations in Tier 2 & Tier 3 cities, Star Air was able to clock 28 – 80% growth on routes that included Pathankot, Belravi, Ajmer, Hindon, and others.

Find opportunistic endeavours

Like Star Air, another erstwhile success story in the regional airline industry was Hyderabad-based carrier TruJet. The beleaguered airline at its peak serviced routes like Mumbai-Nanded, Mumbai-Kolhapur as well as Mumbai-Jalgaon. This was under the RCS-UDAN scheme that offers subsidies to carriers to operate these routes. Since TruJet finds itself grounded indefinitely until an investor infuses fresh funds, Akasa would do well to quickly capture these and similar flight slots and routes to scale fast and early.

Find the right timing

Sometimes, starting anew is easier than rectifying old wrongs. Since it’s starting from scratch, Akasa will have the distinct privilege of going into business without the mountain of debt on its books that most national and regional carriers are trying to wash off.

Airlines like AirAsia & Vistara have raked in a few hundred crores of operating losses — raising eyebrows and questions alike on future business prospects. To Akasa’s benefit, a sparkly clean start — complemented by Rakesh Jhunjhwalla, his consortium of investors, and their committed a war chest of $50m — will come in handy while its competitors grapple with severe cash crunches across the board.

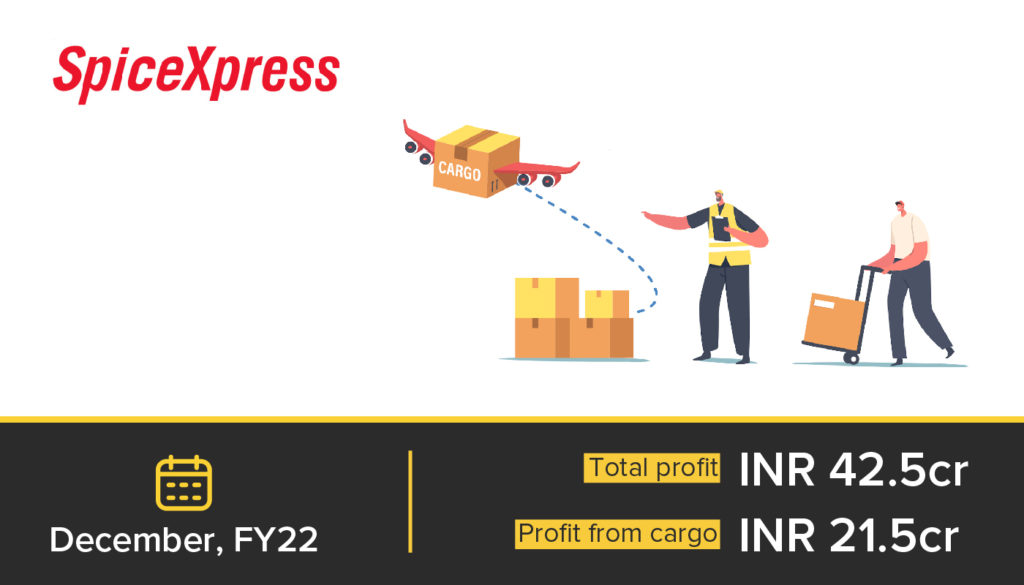

Diversify into cargo

At a time when passenger traffic in the country and the world is unstable, Akasa can look to gather a steady inflow of income from cargo. With commerce and retail making a promising comeback, the economy looks poised for a rosy recovery — and running cargo operations offer the much-needed cushion to keep the wheels turning.

For example, in 2018, SpiceJet, launched a cargo-only service called SpiceXpress, which initially included a fleet of B737s, Q400s, B767s and A330s. The foray into cargo proved to be life-saving for the airline in the post-pandemic world; of SpiceJet’s INR 42.5 cr profit in Dec quarter of FY22, INR 21.5 cr came from cargo. In the quarter before, IndiGo’s cargo revenue grew by 9.6% YOY.

Clearly, Akasa could benefit tremendously from striking the right product mix.

Headwinds

As the world pulls out of three successive waves of the pandemic, the nature of travel, both for business and pleasure, has changed.

Technology has been an enabler for most organisations and a whole lot of meetings that previously took place face to face have comfortably moved to Zoom. While revenge buying in terms of leisure travel has come back with a vengeance, foreign travel — where most airlines make the bulk of their profits, is now limited. Moreover, unlike other ‘leaner’ new-age ventures, an airline company requires significant investment up-front as well as working capital to keep functioning.

Escalating input costs

See a pattern in airline debt here? The culprit is a meteoric global rise in Aviation Turbine Fuel (ATF) which accounts for 30-40% of the airline costs. Despite suffering sharp cuts in March 2020, the cost of crude has nearly doubled two years hence. To make matters worse, the Russian-Ukraine war will only exacerbate supply of oil since Russia accounts for about 10% of the world’s output. If sanctions on oil & gas do come into play in a meaningful way, the cost of fuel could increase even more.

Other costs include long-term engine servicing contracts and dizzying taxations.

Underwhelming passenger demand

Even though carriers are seeing a slight rebound in demand, travel curbs are far from being a thing of the past. This raises a lot of questions around the future of operations and the resulting profitability of domestic carriers. During the year April 2018 to March 2019, airlines in India carried 140 million passengers under domestic services (Government of India, 2019b). However, this number dropped 70% during 2020-2021, although Q4 2022 has staged a recovery on certain routes.

What will this statistic look like with each successive COVID-19 wave? What will be the cost of sustained non-occupancy for a new airline like Akasa Air? It remains to be seen.

Debt financing

Although Akasa Air starts off with a clean slate, the nature of demand in air travel in the coming 2-3 years will determine how long it can escape the debt trap that other airlines have fallen prey to. Consider this: the company has placed an order for 72 Boeing planes with costs over $9 billion. These need to be paid over 5 years, which is a significant drain if flight demands and operations don’t take off in time.

Akasa Air will need to strike the right balance between in-plane occupancy, pricing and frequency on popular routes in order to avoid snowballing losses quarter on quarter — which would delay its break-even and profitability.

Will Akasa Air take flight?

The timing of getting into the airline business could not be better. Managing the state of affairs of air travel is similar to taking a contrarian trade — something that Rakesh Jhunjhunwalla is undoubtedly a master at. However, an excursion into the airline business is rarely a feat for the weak-hearted, only balance sheets and time will tell how this tale pans out.