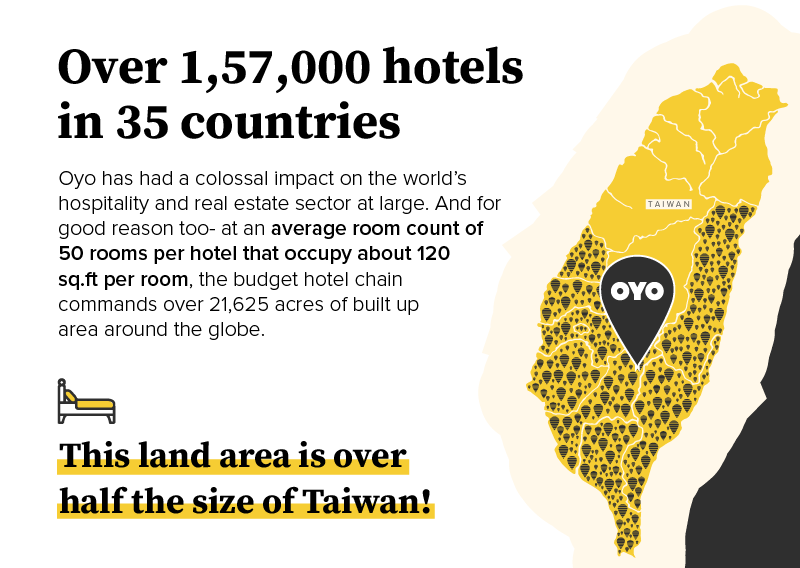

A budget hotel chain with a billion-dollar war chest and the might of Masayoshi San & Softbank, OYO has had a colossal impact on the world’s hospitality sector at large.

Can the ‘OYO model’ be the shot-in-the-arm that SMEs in India need?

Why does the Oyo-model work? Can it be replicated for others?

Despite a list of controversies as long as that of Uber, WeWork, and dare I say Theranos — nobody can deny that the OYO model works.

The largest challenge to budget hotels has always been a lack of predictability. Most middle-class travellers checking into unbranded standalone hotels in tier-2 & 3 locations in the country were essentially signing up for a game of russian roulette. On a good day, you could land in a small boutique property with charming interiors and hospitality. On a bad one, shady guests and sickening linen stains.

Despite that, the brand has single-handedly established the ‘budget’ hotel chain as an industry in itself, collating, compiling and standardising a rather fragmented sector that existed in the space that exists between deep decay & utter neglect.

Can this value ecosystem be emulated across other brick-and-mortar industries, ones that face the largest competition from big brands, to drive significant value and (eventual) profits?

Yes. Let’s look at the ‘how’.

What Kind Of Businesses Demand OYO-fication?

As we saw, predictability in experiences and seemingly intuitive product offerings helped OYO attract a valuation of billions and an addressable market of trillions. So which other industries can scale this strategy with a cookie-cutter approach?

Here’s a simple recipe for replication. You will need:

1. A homogenous product

(with little to no scope for customization)

While there are hordes of product offerings across the board that hinge on product customizations tailored to delight the end customer, certain B2C offerings need not. If a business is able to deliver a consistent predictable quality time after time, the consumer will have little to no motivation to search for an alternative.

2. A large addressable market

(millions, if not billions of users)

As is the case with Oyo, the prize in the pudding lies in structuring an existing fragmented industry. Playing a volume game that delivers small-ticket products to a large user base can prove to be enormously profitable, especially while addressing large populations and developing geographies like SE Asia.

3. A ready-to-operate distribution network

(To hit the ground running with little to no setup)

For most unstructured industries, especially those with brick and mortar presence, the backward integration of the product is already set up, however, there is little reliability in the quality of the product and frequency of performance. Setting up and streamlining processes can go a long way in securing customers and lapping up market share. Given the unstructured nature of these industries, convincing customers to jump ship, especially in the absence of an alternative should not be an uphill task.

4. A memorable, visible brand

(show what sells)

Since the focus is primarily on giving brick & mortar stores a complete overhaul, a visible brand is imperative for on-the-ground recall without allocating a towering marketing budget. Since the success of these models hinges on a large existing distribution network- bold branding can provide exceptional recall in an unorganised market.

Markets Ripe For OYO-fication

Here are our top 3 picks for industries that meet these criteria:

Aggregator For Single Screen Theatres

Let’s face it – India is a pretty cinema-crazed nation. Movie stars are akin to demi-gods with devout fans building elaborate temples out of star-struck adoration. However, in the last decade or so, the movie-viewing experiences in cities have left the middle-class audience out. With the rise of the internet & OTT on one hand & ticket prices moving closer to INR 250–300 apiece on the other, single-screen theatres have gone out of favour.

A budget theatre chain for middle to low-income groups can be a massive opportunity, considering over 7000 single-screen theatres across the country now lie defunct across key locations.

Aggregator For Legacy Hatcheries & Fisheries

The earliest trauma of an urban millennial in India has probably been visiting fish and chicken shops. Most neighbourhood hatcheries are still the same — with live meat being cut right in front of you — while the consumer has moved on to a more sophisticated alternative both online and offline.

An aggregator brand that can onboard these local butcheries, provide training for standardisation of services as well as hygienic packaging can create a superlative hyper-local brand that can capture a market worth approximately 80,000 crores. Sounds yummy, doesn’t it?

Existing brands: Licious and Meatigo exist with completely integrated supply chains. Legacy operators like Venky’s & Godrej Real Good Chicken have created memorable brands.

Aggregator For Dental Clinics

As an industry, medical services have witnessed significant disruption in the last decade. Whether it’s booking applications such as Practo or an aggregator for IVF treatments operating under the brand Chrysta, healthcare can be considered an engine for future growth, given the growing population of the country.

That said, one under-served sector is oral care & dental services, with a large percentage of the industry still remaining unorganised. An aggregator model profiling existing dental clinics on the basis of the resident team’s repute, location and consumer ratings can lead to long-term synergies in an industry that grows over 30–35% a year.

Moreover, an established brand can also target medical tourists that visit India for procedures that are exorbitantly expensive in developed countries.

Existing brands: My Dentist is a brand that has operated in over 200 clinics in metropolitan and Tier-1 cities in India since 2009.

Closing Note

As a consumption-driven economy, India has seen significant disruption across unorganised industries in the last decade, enabling tremendous value to consumers in business categories that were earlier marred by inconsistencies and, on occasion, sheer laziness.

Will this decade bring structure to others? Only time will tell.