The EV sector in India is buzzing.

More and more consumers are embracing electric vehicles as fuel prices surge. The pace of innovation is at an all-time high – and like frantic mad scientists, R&D departments of vehicle manufacturers are eager to capitalise on the subsidies that the Indian government is offering (all in a bid to meet its climate change targets).

One exciting and relatively new segment of the industry is the electric scooter rental market.

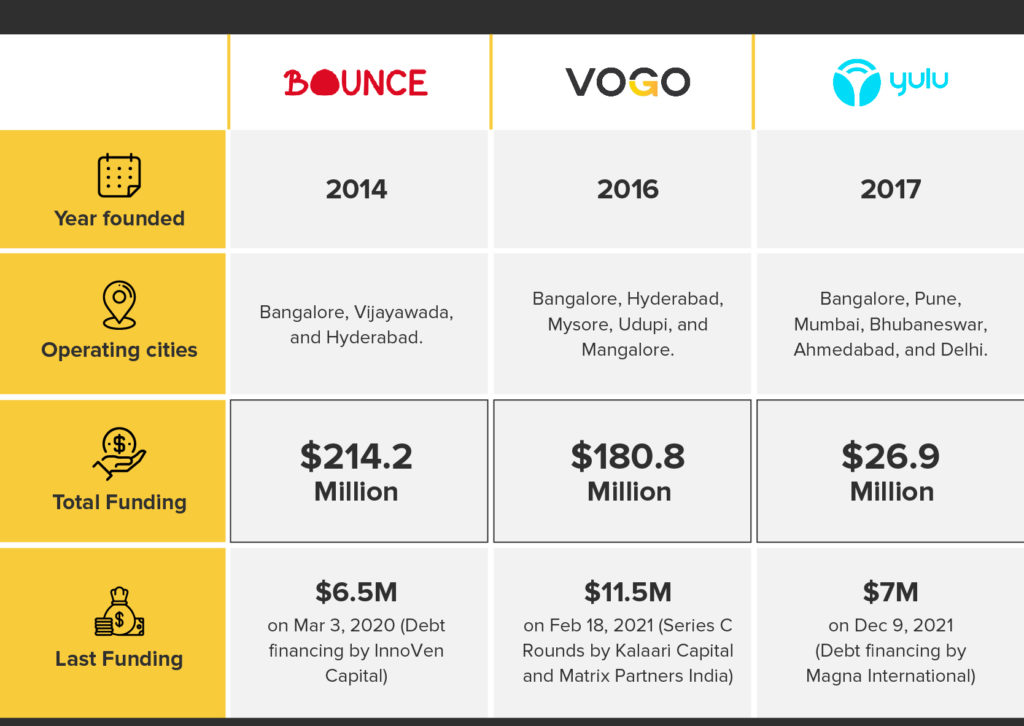

India’s largest e-scooter rental players

While traditionally eScooters had to be charged at charging stations, the name of the game now is Battery-as-a-Service (BaaS) where, instead of charging your whole vehicle, you swap your battery for a fully charged one at a charging station when required.

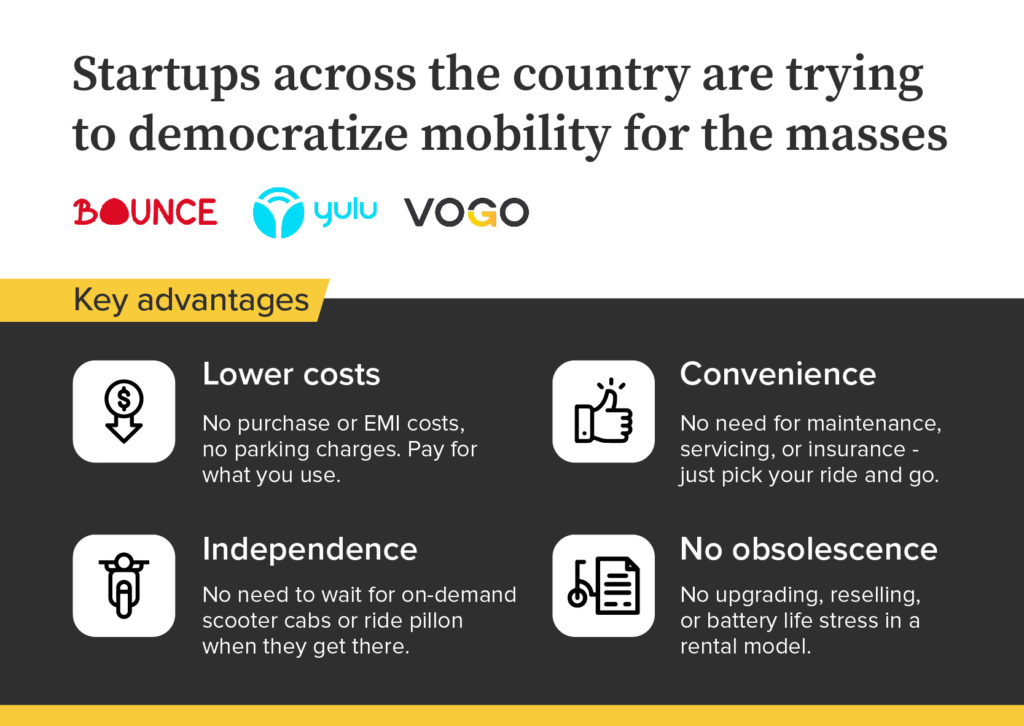

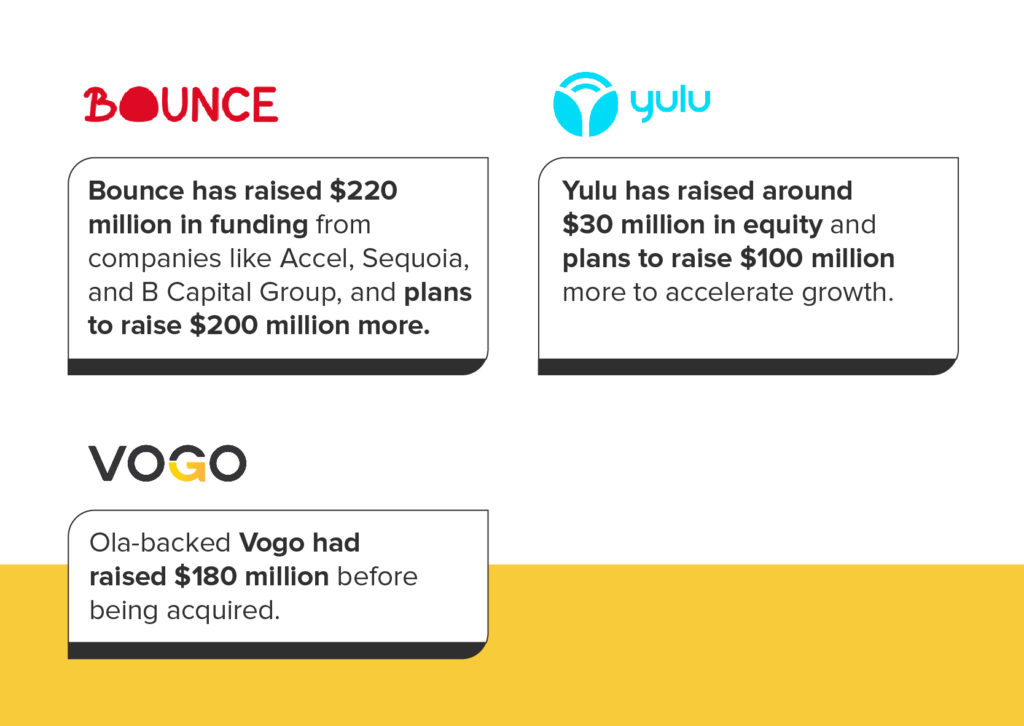

E-scooter rental startups like Bounce, Yulu, and Vogo are hoping to revolutionise shared micro-mobility in urban India. However, despite government support and consumer interest, these companies have been losing money and are far from becoming profitable.

So are they doomed? Investors don’t think so. They’re betting big that India’s future is electric.

Let’s see why.

This revolution will not be televised

Transition to EV is a worldwide phenomenon. Electrifying vehicles is critical to decarbonising transportation, one of the major contributors to climate change.

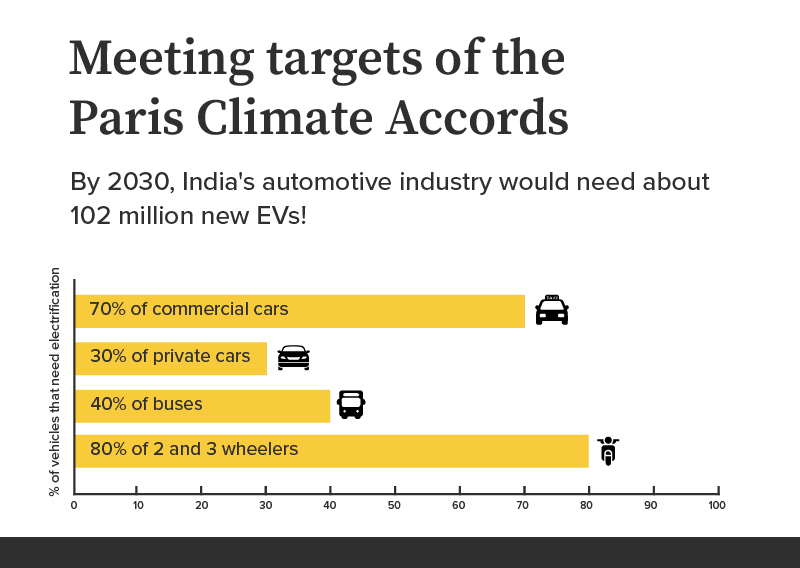

As part of the Paris Accords, India has set an ambitious electrification target – and will need a significant change in mobility to make it happen.

Meeting this 2030 target could provide an investment opportunity of about $200 billion and it would cut India’s road transport emissions by 15%.

So the EV revolution is already underway, and the adoption is likely to grow thanks to political will to move towards clean mobility. The government announced FAME-II, a scheme to push EV adoption in India. Similarly, Niti Aayog has released a draft battery swapping policy that will make these vehicles interoperable and improve the efficiency of the ecosystem by pushing BaaS. This is expected to benefit all stakeholders in the battery swapping ecosystem – end-users, energy operators, OEMs, real estate owners, power companies, and the government.

Last year, India saw unprecedented growth in the e-scooter market where sales went up by 132%.

Why is shared micro-mobility so lucrative?

The current EV market is reminiscent of the heyday of Uber – when it pioneered mobility-as-a-service. At the time it achieved something nearly impossible, it changed people’s mindsets. It brought shared mobility to the global stage and made it as accessible as clicking a button.

E-scooter rental startups in India want to achieve something similar today.

Niti Aayog estimates that by 2030, 35% of all passenger miles in India will be on shared transport and by 2040, 50% of passenger miles will be on shared transport. But shared mobility has ignored micro-mobility – which includes bicycles, e-scooters, and small electric vehicles with one or two seats – till now, even though two-wheelers are by far the largest vehicle segment in India.

Rapid urbanisation is taking place in India with the urban population set to double in the next decade. Already road congestion is back to pre-pandemic levels and the air quality is suffering. There is a lot of pressure on the urban transport infrastructure. Last-mile mobility for the population – i.e. from their home to public transportation and back – is missing.

Shared micro-mobility just makes sense.

So what’s the problem?

All that sounds very noble, but let’s take a look at the current scenario and how close we are to achieving this utopia of shared micro-mobility.

Bounce is the biggest player in the E-scooter rental space. Prior to the pandemic, it was doing 120,000 rides per day in Bangalore alone. But its business shrank by 83% in FY20-21. As a result, it laid off 40-60% of its staff in February 2021. It has since pivoted to become an OEM and has also set up a robust network of battery swapping stations but remains unprofitable.

Yulu runs the largest BaaS network in the country and has tied up with Bajaj Auto for sourcing its scooters. In a dismal FY2020, it suffered more than 20 crores in losses, essentially spending triple the amount of money it made. Vogo – which reported 2X growth in revenue but 94X growth in expenses in FY19 – had to lay off 15% of its workforce in 2020. It was recently acquired by Mumbai-based Chalo, a mobile app that helps users track buses across cities and book bus tickets online.

These stories are reminiscent of the infamous case of the Chinese bike-sharing startup Ofo which was backed by the Alibaba Group and had a dramatic rise – followed by an equally dramatic and public crash. So why are these companies not performing well?

Here are the three biggest deterrents for these startups:

1. Range Anxiety

The biggest deterrent when it comes to customers adopting e-scooters is that they don’t cover much ground.

Of the e-scooters rentals available in India, most offer only about 60-80 kilometres of range in one charge. This means riders experience heightened anxiety about whether they will reach their destination – or at least a charging/battery-swapping station – before their battery runs out.

The main driver behind this is the lack of infrastructure for EVs in India. There just aren’t enough charging stations and building new ones is costly. According to a Grant Thornton Bharat-FICCI poll, India would need 400,000 charging stations by 2026 to meet the demand for two million electric vehicles on the road. There is a long way to go to meet this demand. Battery swapping should ease these anxieties a bit, but again, the battery swapping infrastructure is young and undeveloped.

Companies will either have to invest in EV infrastructure themselves or restrict themselves to smaller areas to tackle range anxiety.

2. Vandalism

Vandalism of ride-share two-wheelers is a huge problem in the country. There have been multiple cases of cycles and bikes being stolen from their parking stands or vandalised. According to Yulu, around 300 of its bikes were vandalised or stolen between 2018-19 which net a loss of 40-50 lakhs. Pune authorities claimed that 25% of bikes in the city’s bike-share plan were vandalised.

These incidents are not only a financial loss in the direct sense, they also make customers feel unsafe and discouraged in the long run. Startups are tackling this problem by:

- Making their vehicles theft-proof by tagging the scooters and helmets with trackers.

- Setting up designated zones for parking that are monitored by CCTV cameras or bike marshal teams instead of a free-float model.

- Penalising riders for not parking within designated areas. Yulu claimed that it penalised 29,382 users ₹20-40 for this reason in a period of six months.

- Working with the police to recover vehicles and cancel driving licences of errant users.

3. Cost

These startups are already asset-heavy businesses in most cases because they own their own vehicles, unlike ride-share companies like Ola and Uber. And the vehicles are not cheap.

The battery accounts for around 60% of the total cost of manufacturing the scooter and uses metals such as lithium, cobalt, nickel, and manganese. These raw materials are expensive and the costs have scaled drastically in the last two years.

Startups will also need to invest in setting up charging infrastructure and participating in strengthening the entire EV ecosystem which includes swappable batteries, charging grids, energy storage, and energy management. There is also the high cost of using coal-powered electricity to keep the vehicles running. The industry might have underestimated the operating costs – currently, for every rupee earned, they are spending three times as much.

The government of India is working with these startups to reduce these costs. Although the government managed to disburse only about 10% of the Rs. 8,596 crores earmarked as subsidies under the FAME-II scheme, it is making more efforts to push EV adoption. There have been discussions about slashing GST on EV batteries from 18% to 5%. The Indian government also launched a Production Linked Incentive (PLI) scheme for manufacturing these batteries with an outlay of Rs. 31,600 crores by 2030.

Secondly, companies will have to fix the unit economies to actually start making money. A study compared how much one electric cycle of the US-based ride-sharing app Bird was utilised compared to one Uber car. The difference was vast with one bike being utilised only 12.5% of the day compared to Uber which had a rate of 58%. The scooters will have to be utilised a lot more for the investment to make sense. Awareness building among commuters through marketing channels needs to take place.

Alternate Use-cases For The E-Scooter Rental Market

The traditional e-scooter rental model might keep growing as the EV infrastructure of the country grows and the adoption rate rises. But in the meantime, what other avenues can these companies explore to increase their bottom line?

1. Intra-campus services

One way to reduce range anxiety is to go hyperlocal. There is a huge potential to tie up with university and office campuses and offer ride-sharing to students and employees to ease transportation. In fact, many campuses are already doing this with electric cycles. Hero Hexi, a tie-up between Hero and China-based Youno, is already present across some university campuses like Vadodara’s MSU and Jalandhar’s LPU. The same service can be used for offices with big campuses or other hyperlocal areas in the cities, as can be seen in Mumbai’s BKC area. The service Tilt offers bike-sharing services across large residential campuses. These bikes are easy to maintain since they are contained within one area, and offering monthly or yearly subscriptions to users has a lot of potential.

2. Metro feeder services

Cities are pushing metro services to tie up with e-scooter rental companies to provide last-mile connectivity to their residents. Widely available pickup points will mean customers can walk up to an e-scooter, unlock it with an OTP sent to their phone, and drive themselves to the metro. This will help ease traffic congestion and is a much cheaper option than hailing a cab. These services have started in some cities like Lucknow, Delhi, and Nagpur while other cities are considering them. An added advantage of this use case is that it reduces costs for the companies by providing them with parking spaces and sharing charging costs.

3. Partnering with delivery services

The food and grocery delivery business in India is set to become a $6 billion profitable market by 2024. Many e-scooter rental startups are tying up with these delivery services and logistic companies to provide electric vehicles to their riders. This practice is encouraged by governments with the Delhi government recommending that businesses involved in e-commerce, logistics, and delivery, transition at least 50% of their delivery fleets to electric by 2023, followed by a complete 100% switch by 2025.

Since these scooters have a maximum speed of 25 kmph, they don’t require a driving licence or address proof, which greatly increases the labour pool for these companies. An average gig worker earns ₹900-1,000 a day while companies like Yulu offer e-scooter rentals for ₹180-190 a day. With fuel prices soaring, EV rentals are even more attractive.

Shared Electric Mobility – India’s Future?

It’s clear to see that this market has a lot of potential. Investors are still confident that these startups have a bright future, despite none being profitable yet.

The government is working with these companies to ensure the public adopts EVs. Indian consumers are becoming more environmentally conscious much like their international counterparts. In a survey conducted by McKinsey, almost 70% of people worldwide said they would like to use micro-mobility vehicles for their daily commute.

Even the Chinese bike-sharing market recovered after Ofo’s massive crash. If anything, the Chinese market learned from its mistakes and in the aftermath, the industry is more stable with firms like Qingju, Meituan, and Hello becoming very successful. According to a 2020 report, these three companies were present in a combined 400 cities and had tens of millions of monthly active users.

So it is safe to say that despite the challenges, the future of Indian shared electric micromobility startups looks promising.